WISO Steuer Sparbuch 2021 v28.01 Build 1828 Crack + Pre-Activated 2024

WISO Steuer Sparbuch

2021 v28.01 Build 1828

March 5, 2024

buhl

Educational & Business

585 MB

WISO Steuer Sparbuch With Crack

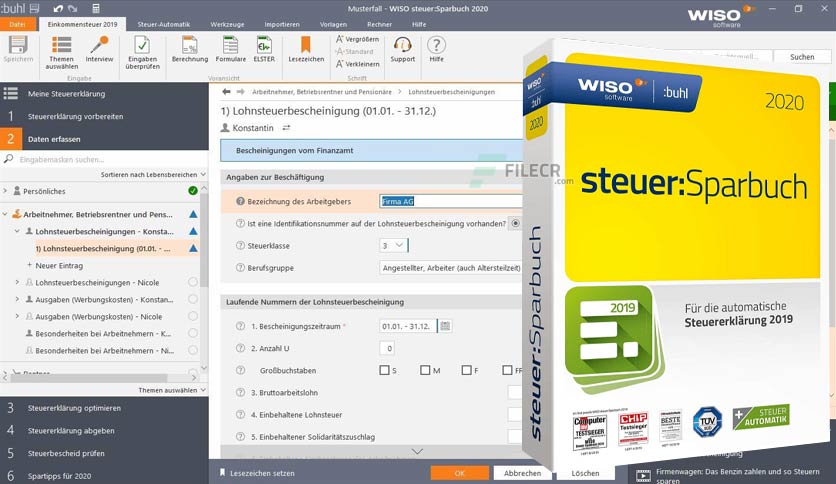

WISO Steuer Sparbuch 2021 v28.01 Build 1828 Crack is a comprehensive and user-friendly software designed to assist individuals in optimizing their tax return process. Tailored for German taxpayers, this version of WISO Steuer Sparbuch introduces advanced features and enhancements to simplify the often complex task of tax declaration. Whether you are a freelancer, self-employed professional, or an individual with various sources of income, WISO Steuer Sparbuch Full Crack offers a reliable and efficient solution to maximize deductions and ensure compliance with the latest tax regulations. With an intuitive interface and robust set of tools, users can navigate through the tax filing process seamlessly, providing a hassle-free experience for managing their financial obligations.

WISO Steuer Sparbuch Torrent Crack includes an array of features to empower users in handling their tax affairs effectively. The software covers a wide range of tax-related scenarios, allowing users to input income from employment, self-employment, capital gains, and other sources. WISO Steuer Sparbuch Mac Crack provides comprehensive guidance on deductible expenses, ensuring users can claim all eligible deductions to optimize their tax refund. Additionally, the integrated audit-check feature helps users identify potential errors and ensures the accuracy of their tax declaration. With support for electronic submission to tax authorities, WISO Steuer Sparbuch Latest Crack streamlines the entire tax return process, making it an indispensable tool for individuals seeking a reliable and up-to-date solution for their tax planning needs.

Key Features of WISO Steuer Sparbuch Crack

1. Income Source Variety:

Covers a wide range of income sources, including employment, self-employment, capital gains, and more, ensuring comprehensive tax coverage.

2. Deduction Optimization:

Provides guidance on deductible expenses to help users maximize deductions and optimize their tax refund.

3. Audit-Check Feature:

Includes an audit-check feature to identify potential errors and ensure the accuracy of the tax declaration, minimizing the risk of audits.

4. Electronic Submission:

Supports electronic submission of tax declarations to authorities, streamlining the filing process and ensuring compliance with regulations.

5. User-Friendly Interface:

Designed with an intuitive and user-friendly interface, making it accessible to users of all levels of tax knowledge and experience.

System Requirements

Minimum System Requirements:

– Operating System: Windows 7 or later

– Processor: 1 GHz or faster

– RAM: 1 GB or more

– Hard Disk Space: 2 GB of free space

WISO Steuer Sparbuch 2021 v28.01 Build 1828 100% Working Keys 2024

WISO Steuer Sparbuch Product Key

MUUY2-4DRVS-X5TNJ-KI94N-KHV5B

014OK-QYG97-K7SZI-BRC9D-YK7ZE

WISO Steuer Sparbuch Serial Key

BXE60-HWYIG-3JF0U-WTO7K-WX20D

Y76LA-EXOI4-1KL2H-WFHAG-4E0B2

WISO Steuer Sparbuch Activation Code

Q9G98-X7RSH-Z7FZL-SLV02-NTCEW

55J83-5A4YG-YK15T-B98RX-7TMFT

WISO Steuer Sparbuch License Key

4HN2S-H7TYF-75M6T-588QA-CZ4DG

T8A9Q-QE66R-F6P5C-O0V2P-V1REC

How To Crack & Install WISO Steuer Sparbuch 2021 v28.01 Build 1828

- First download the latest version.

- Uninstall the previous version with Soft Uninstaller, If Installed.

- Note Turn off the Virus Guard.

- After downloading Unpack or extract the rar file and open setup (use Winrar to extract).

- Install the setup after installation close it from everywhere.

- Please use Keygen to activate the program.

- After all of these enjoy the WISO Steuer Sparbuch 2021 v28.01 Build 1828 Crack Latest Version 2024.